Banks have digitalized their services to offer the best experience to their clients. As a result, it is now of current use to check accounts and transfer money from mobile banking applications, arousing the interest of hackers to exploit the wide mobile attack surface. Facing this new vector of threats, the Bank to which this use case refers decided to ensure the security of its mobile banking application by leveraging Pradeo Security Runtime Application Self-Protection (RASP) solution.

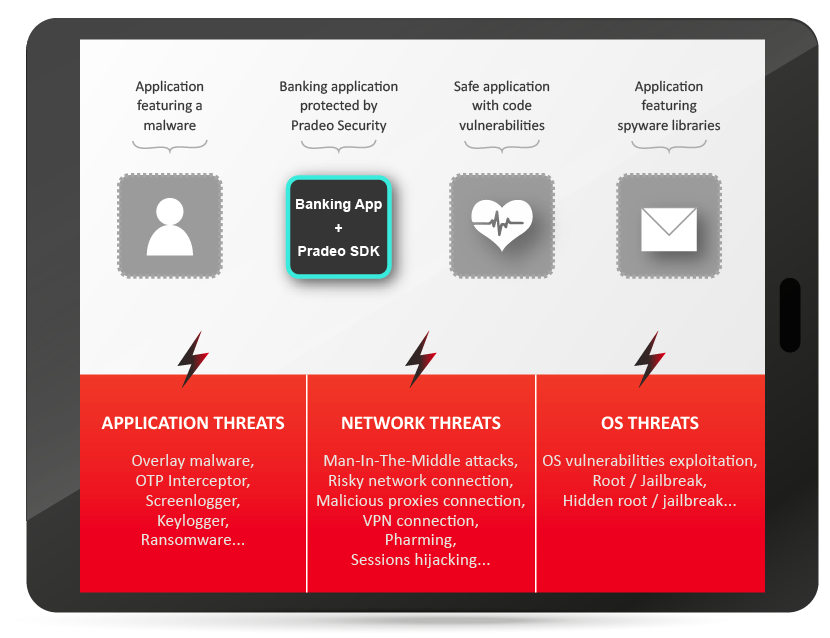

Pradeo Security Application Self-Protection detects threats running on end-users mobile devices to protect the mobile banking application from fraud and data leakage. By directly acting on-device, it offers a real-time protection against the ever-growing mobile threats and reinforces the bank compliance with data protection regulations.

The financial institution uses Pradeo Security Application Self-Protection and Threat Intelligence module to proactively protect its mobile banking users and populate its SIEM database with mobile security data.

- Ranked among TOP 20 global banks

- Millions of mobile users

- Millions of security data processed every day

Download the Use Case

-1.png)

-1.png)

.png)